Page 18 - ISQ UK_October 2017

P. 18

INVESTMENT STRATEGY QUARTERLY

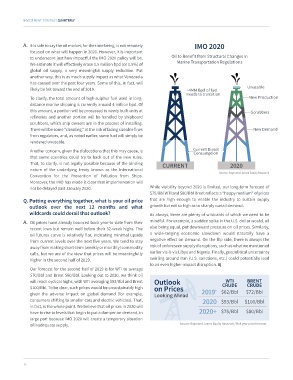

A. It is safe to say the oil market, for the time being, is not remotely IMO 2020

focused on what will happen in 2020. However, it is important

to underscore just how impactful the IMO 2020 policy will be. Oil to Benefit from Structural Changes in

We estimate it will effectively erase 1.5 million bpd (or 1.5%) of Marine Transportation Regulations

global oil supply, a very meaningful supply reduction. Put

another way, this is as much supply impact as what Venezuela

has caused over the past four years. Some of this, in fact, will

likely be felt toward the end of 2019. ~4MM Bpd of fuel Unusable

needs to transition

To clarify, the total amount of high-sulphur fuel used in long- New Production

distance marine shipping is currently around 4 million bpd. Of

this amount, a portion will be processed in newly built units at Scrubbers

refineries and another portion will be handled by shipboard

scrubbers, which ship owners are in the process of installing.

There will be some “cheating,” at the risk of facing sizeable fines New Demand

from regulators, and, as noted earlier, some fuel will simply be

rendered unusable.

Another concern, given the dislocations that this may cause, is Current Diesel

Consumption

that some countries could try to back out of the new rules.

That, to clarify, is not legally possible because of the binding CURRENT 2020

nature of the underlying treaty known as the International

Convention for the Prevention of Pollution from Ships. Source: Raymond James Equity Research

Moreover, the IMO has made it clear that implementation will

not be delayed past January 2020. While visibility beyond 2020 is limited, our long-term forecast of

$75/Bbl WTI and $80/Bbl Brent reflects a “happy medium” of prices

Q. Putting everything together, what is your oil price that are high enough to enable the industry to sustain supply

outlook over the next 12 months and what growth but not so high as to sharply curtail demand.

wildcards could derail that outlook? As always, there are plenty of wildcards of which we need to be

A. Oil prices have already bounced back year-to-date from their mindful. For example, a sudden spike in the U.S. dollar would, all

recent lows but remain well below their 52-week highs. The else being equal, put downward pressure on oil prices. Similarly,

oil futures curve is relatively flat, indicating minimal upside a wide-ranging economic slowdown would naturally have a

from current levels over the next five years. We tend to stay negative effect on demand. On the flip side, there is always the

away from making short-term (weekly or monthly) commodity risk of unforeseen supply disruptions, such as what we mentioned

calls, but we are of the view that prices will be meaningfully earlier vis-à-vis Libya and Nigeria. Finally, geopolitical uncertainty

higher in the second half of 2019. swirling around Iran (U.S. sanctions, etc.) could potentially lead

to an even higher-impact disruption.

Our forecast for the second half of 2019 is for WTI to average

$70/Bbl and Brent $80/Bbl. Looking out to 2020, we think oil

will reach cyclical highs, with WTI averaging $93/Bbl and Brent Outlook WTI BRENT

$100/Bbl. To be clear, such prices would be unsustainably high on Prices CRUDE CRUDE

given the adverse impact on global demand (for example, Looking Ahead 2019 * $62/Bbl $72/Bbl

consumers shifting to smaller cars and electric vehicles). That, 2020 $93/Bbl $100/Bbl

in fact, is the whole point. We believe that oil prices in 2020 will

have to rise to levels that begin to put a damper on demand, in 2020+ $75/Bbl $80/Bbl

large part because IMO 2020 will create a temporary situation

of inadequate supply. Source: Raymond James Equity Research; *Full year price forecast

17