Page 4 - Growth Plan Newsletter

P. 4

changes ‘at the earliest opportunity’. The email also said that ‘HMRC will be directing employees to their employers to

correct any overpaid NICs in the first instance.’

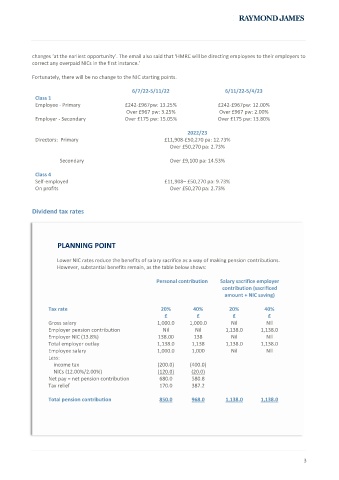

Fortunately, there will be no change to the NIC starting points.

6/7/22-5/11/22 6/11/22-5/4/23

Class 1

Employee - Primary £242-£967pw: 13.25% £242-£967pw: 12.00%

Over £967 pw: 3.25% Over £967 pw: 2.00%

Employer - Secondary Over £175 pw: 15.05% Over £175 pw: 13.80%

2022/23

Directors: Primary £11,908-£50,270 pa: 12.73%

Over £50,270 pa: 2.73%

Secondary Over £9,100 pa: 14.53%

Class 4

Self-employed £11,908– £50,270 pa: 9.73%

On profits Over £50,270 pa: 2.73%

Dividend tax rates

PLANNING POINT

Lower NIC rates reduce the benefits of salary sacrifice as a way of making pension contributions.

However, substantial benefits remain, as the table below shows:

Personal contribution Salary sacrifice employer

contribution (sacrificed

amount + NIC saving)

Tax rate 20% 40% 20% 40%

£ £ £ £

Gross salary 1,000.0 1,000.0 Nil Nil

Employer pension contribution Nil Nil 1,138.0 1,138.0

Employer NIC (13.8%) 138.00 138 Nil Nil

Total employer outlay 1,138.0 1,138 1,138.0 1,138.0

Employee salary 1,000.0 1,000 Nil Nil

Less:

income tax (200.0) (400.0)

NICs (12.00%/2.00%) (120.0) (20.0)

Net pay = net pension contribution 680.0 580.8

Tax relief 170.0 387.2

Total pension contribution 850.0 968.0 1,138.0 1,138.0

3